Contribution Information

- County Programs - You may donate to help those who live in Sacramento County.

- Federations - You may donate to one or all Federations who are participating in the Campaign.

- Charitable 501(c)(3) Organizations - You may give to one or more charities by entering their codes, which are listed in the Employee Giving Campaign Brochure.

Note: Only charitable organizations qualified as exempt under paragraph (3) of subsection (c) of Section 501 of the United States Internal Revenue Code of 1954 qualify to receive designations. Status is verified prior to payments. If an agency does not qualify, the donor will be notified. Approved expenses are deducted before designations are distributed. America's Best Charities will process all contributions made to 501(c)(3) organizations that are not under a Federation.

How Would You Like to Give?

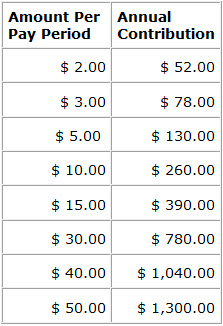

Option 1: Payroll Deduction - Contributions made through payroll deductions will be deducted beginning in Pay Period 1, (December 17, 2023), and continue through Pay Period 26, (December 14, 2024). You can donate through payroll deduction using the new Employee Giving Website. Review the video for instruction.

- Option 2: One-time Donations - Contributions can be made through the Giving Website using a debit/credit card.

Deciding How Much